Want to know what the smartest hedge fund managers are doing? Street of Walls compiled data from 13F SEC filings in order to analyze how the top hedge fund managers have made changes to their portfolios.

Want to know what the smartest hedge fund managers are doing? Street of Walls compiled data from 13F SEC filings in order to analyze how the top hedge fund managers have made changes to their portfolios.

We analyzed top hedge funds including Greenlight, Pershing Square, Maverick, Third Point, Paulson, and 15 others. To view full report check out the 4Q HF Intelligence here.

Sign up for the 2012 reports:

Quick Street of Walls Takeaways:

- The most crowded new ideas during the quarter were DLPH, LMCA, and GLD. Other new positions shared among hedge funds but with less overlap were ORCL, VRUS, QCOM, YHOO, URI, TXN, WFC, and GOOG.

- Fund managers are adding exposure back into Financials and Healthcare after huge declines the last several quarters. Government reimbursement risks associated with the Healthcare sector and low rates and mortgage related put-back problems in Financials may have led managers to trim and exit positions within the space over 2Q11 and 3Q11 and re-enter under attractive valuations in 4Q11.

- We found a majority of hedge funds largest positions were shared amongst the hedge funds in our universe. AAPL was by far the most crowded position in the top 8 holdings for hedge funds: Greenlight, Lone Pine, Blue Ridge, Coatue, and Tiger all have AAPL as the largest position in their holdings. Other large crowded positions include GOOG, QCOM, LMCA, and AMT.

- On average the funds listed below bought companies with a 2011 forward price to earnings ratio of 18.6x. Appaloosa and Baupost bought into the higher valuation stocks at 47.4x and 28.6x respectively while Glenview and Greenlight bought into much lower valuations at 13.4x and 14.1x respectively.

Introduction on 13F Filings: Registered hedge funds over $100 million are required by the Securities and Exchange Commission (SEC) to file quarterly updates on portfolio holdings. These holdings are filed online through form 13-F at sec.gov. Hedge funds are required to file these holdings no later than 45 days after the end of the calendar quarter. The Street of Walls team compiled very detailed analyses on 20 of the top Hedge Funds in the industry. This report focuses on hedge fund positions at the start of 4Q 2011 and looks at meaningful changes from the previous quarter. The report is based on 23 of the top hedge funds.

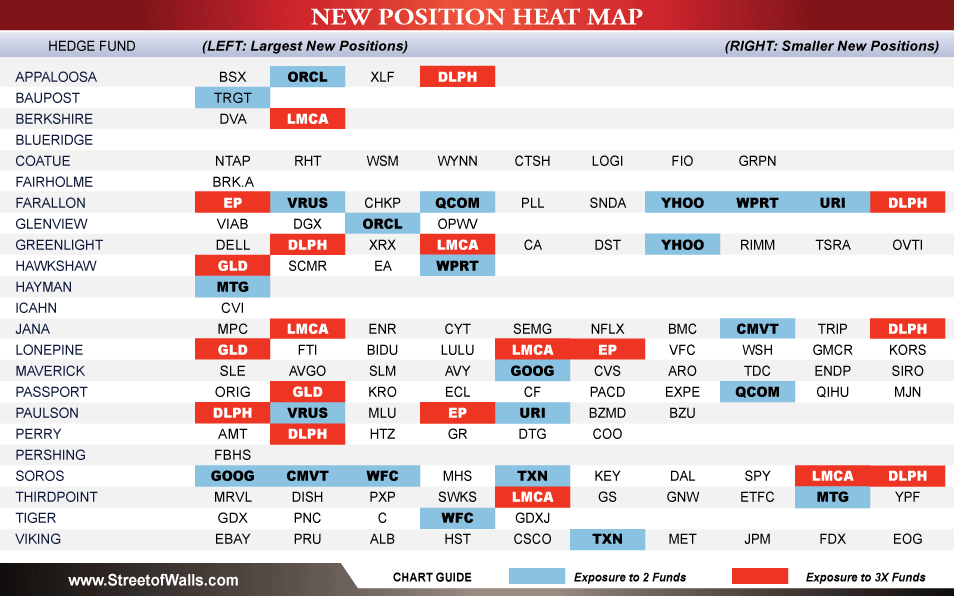

NEW Position Heat Map:

During 3Q11, the top 23 hedge funds entered many new positions. The Heat Map below identifies the top NEW positions added during the quarter. NEW names were not previously held in 2Q11. Tickers in Red represent common or “crowded” positions. The most crowded new ideas during the quarter were DLPH, LMCA, and GLD. Other new positions shared among hedge funds but with less overlap were ORCL, VRUS, QCOM, YHOO, URI, TXN, WFC, and GOOG.

Full Report: Hedge Fund Intelligence

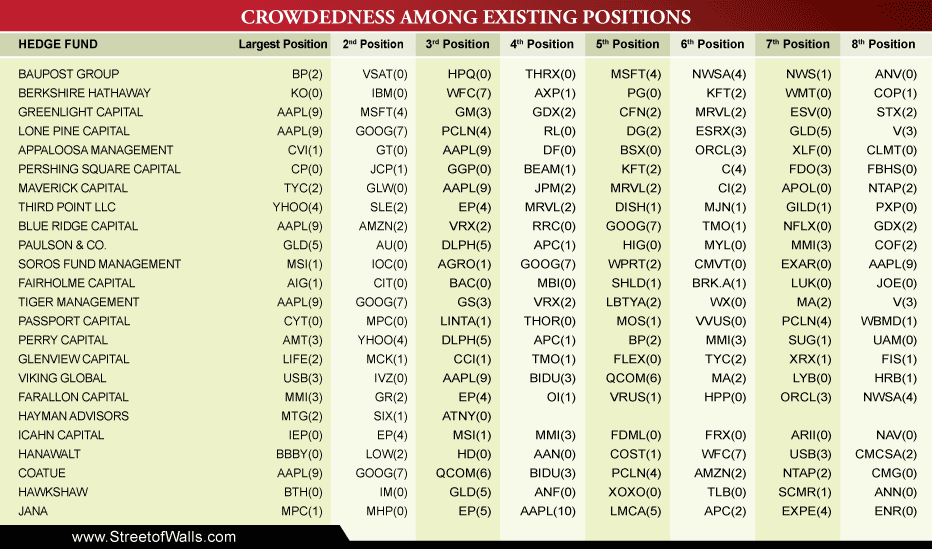

Crowdedness Among Existing Positions:

Below we break-down the most shared stocks held in at the top 23 hedge funds. Crowded trades can lead to higher than normal share price volatility. We examined the number of positions that were shared among our hedge fund universe, giving us an understanding of how the herd is acting. For the top 23 hedge funds we cover, the most crowded books were from Jana, Farallon, Lone Pine, Maverick, Tiger, and Blue Ridge (lots of Tiger Cubs in there). The least crowded positions among the books were held at Berkshire, Baupost, Hayman, Icahn, and Hawkshaw.

Full Report: Hedge Fund Intelligence

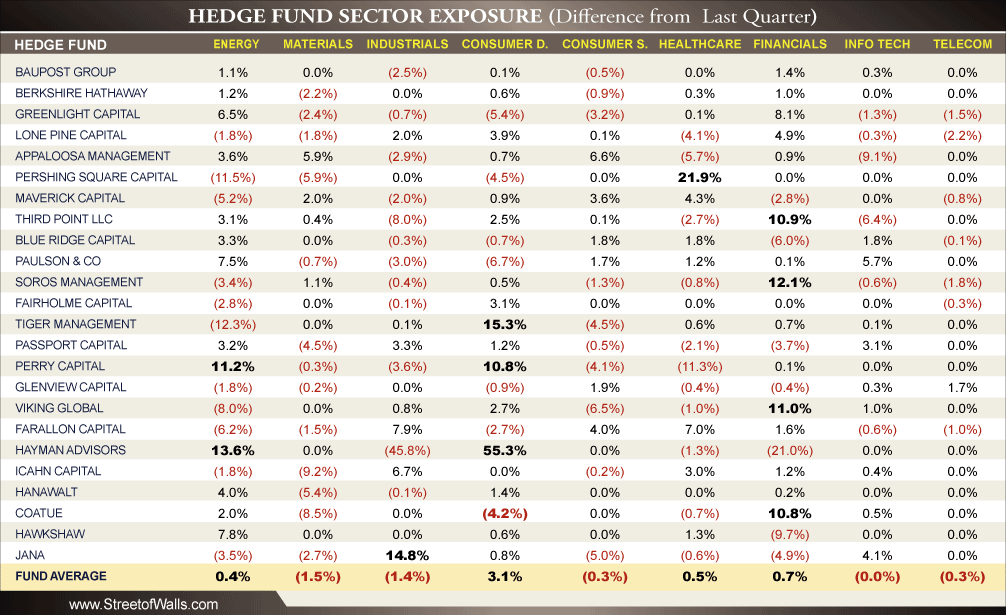

Hedge Fund Sector Changes:

The percentages below show quarterly changes in sector weighting allocations (as defined by S&P GICS) for each hedge fund we cover. For example, as defined by publicly available data Baupost increased portfolio allocation ($ amount) into Energy by +1.1% from 3Q11 to 4Q11.

There was a big push within the quarter to Consumer Discretionary (+3.1%), Financials (+0.7%), and Healthcare (+0.5%) while Industrials (-1.4%) and Materials (-1.5%) declined the most.

Fund managers are adding exposure back into Financials and Healthcare after huge declines the last several quarters.Government reimbursement risks associated with the Healthcare sector and low rates and mortgage related put-back problems in Financials may have led managers to trim and exit positions within the space over 2Q11 and 3Q11 and re-enter under attractive valuations in 4Q11.

Full Report: Hedge Fund Intelligence

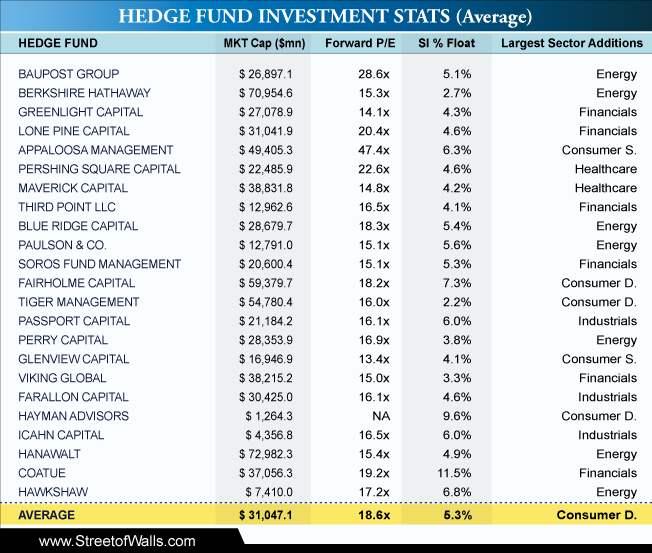

Hedge Fund Investment Characteristics:

Out of the 23 hedge funds examined, Consumer Discretionary was the leading sector for investment in 4Q11 (as a % of sector investments from last quarter) followed by Energy and Technology.

The average market capitalization of hedge fund portfolio companies was $31.0 billion up from $26.5 billion last quarter.Berkshire and Hanawalt had the highest average market cap exposure while Icahn and Hayman Advisors had the lowest average market cap exposure. On average the funds listed below bought companies with a 2011 forward price to earnings ratio of 18.6x. Appaloosa and Baupost bought into the higher valuation stocks at 47.4x and 28.6x respectively while Glenview and Greenlight bought into much lower valuations at 13.4x and 14.1x respectively.

Short interest as a percentage of publicly traded floating shares was an average of 5.3% across the 23 funds vs. 5.5% last quarter. Coatue and Hayman had the highest short interest with 11.5% and 9.6% while Berkshire and Tiger had the lowest with 2.7% and 2.2%. Owning stocks with high short interest is a sign of contrarian investing.

Full Report: Hedge Fund Intelligence

Sign up for the 2012 reports today (will not spam):

Full Report: Hedge Fund Intelligence