Hedge funds are always looking to solve problems. Pitching a stock during a hedge fund interview should be no different. You need to find investment ideas on both the long and short side that are ambiguous and variant.

If everyone knows the same thesis as you, can you make money? It’s possible but highly unlikely. This isn’t to say you have to solve a complex problem that nobody else can; it just means you need to be at the forefront of understanding the future possibilities and how that affects your company.

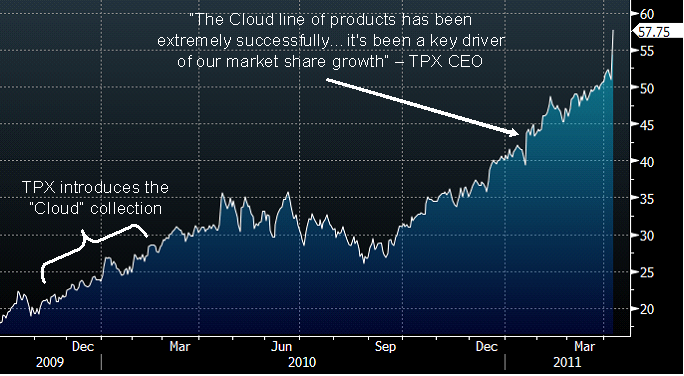

A good example is Temper-Pedic (Ticker TPX). In early 2010, TPX announced a new collection, the “TEMPUR-Cloud.”

The bedding industry is divided up between “hard” and “soft” mattress: some people prefer hard mattresses and others prefer soft. It just so happens that the soft mattress market dominated; about 75% of all U.S. mattresses sales are soft. Before early 2010, TPX was competing only in the hard mattress business which has a 25% market share. With the launch of the “Cloud” series, TPX could now compete in the large soft mattress industry.

Did investors understand the market potential? Yes.

Did it take +16 months for investors to understand the real market potential? Yes.

Quick checks with mattress retailers would have told you that salespeople could hardly keep the TPX Cloud in stock – sales were surging and the company was taking unbelievable market share. It didn’t take a rocket scientist to figure out this new product was a big deal.

TPX Stock Price since announcement:

Picking good investments is all about solving problems, and the world is full of them.