Walking me through a Comparable Company Analysis?

One of the most used valuation methods used in Investment Banking is Comparable Company Analysis (aka Comps). Comps are a valuation technique that is based on the idea that companies with similar characteristics should have similar valuation multiples. A group of comparable companies includes companies from the same industry as the company that is being valued with similar products, customers, geography, and distribution channel.

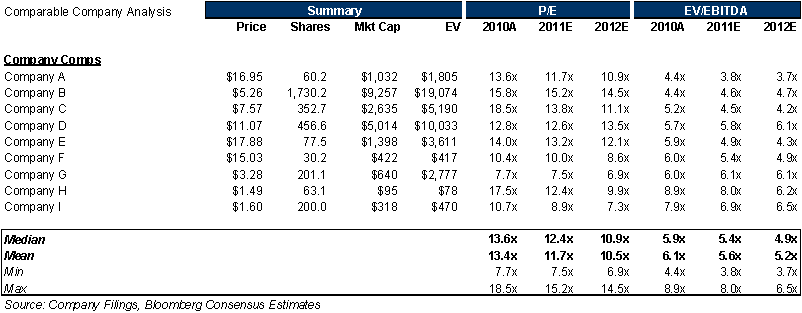

Exhibit taken from the DCF Model (Comps included in the file):

Assumptions for Company F:

- Company F Shares of 400

- Total Debt of $5,000

- Cash of $2,000

Company F has an estimated EPS of $1.35 in 2011. How much is it worth using comps above?

Calculation:

- Comp Set above is trading at 14.4x 2011 Earnings Per Share

- Company F has a 2011 estimated EPS of $1.35

- 14.4 * $1.35 = $19.44 (P/E multiples gives us Market value per share so we are done)

Company F has an estimated EBITDA of $350 in 2011. How much is it worth using comps above?

Calculation:

- Comp Set above is trading at 13.1x 2011 EBITDA

- Company F has a 2011 estimated EBITDA of $800

- 13.1 * $350 = $10,480 (this is the Enterprise Value, need to back out Net Debt to get to Market Value)

- $4,585 – $5,000 + $2,000 = $7,480 (This is Market Value, need to divided by shares to get price)

- $7,480 % 400 = $18.70

Conclusion: Based on comparable company analysis Comp F is worth between $18.70-$19.44 based on 2011 P/E and EBITDA multiples of public competitors.

Other interesting articles: