Precedent Transaction Analysis (sometimes called “historical transaction”) is one of the major company valuation analyses down in investment banking. This is a historical valuation method where you will be comparing past transactions in order to gauge current valuation of your company. In this exercise we will break down the steps used in precedent transaction analysis.

The other major valuation methodologies include Comparable Transaction and Discounted Cash Flow.

Step 1: Selecting the Universe of Transactions

The first step is selecting your universe of historical transactions you will be using in your valuation. You will be screening for historical transactions where the target company is similar to the company you are valuing.

The historical screen is usually done in one of two ways:

- Your investment banking deal team or Managing Director (MD) will tell you what transactions to look at: i.e. you MD might say “use these 4 transactions for your analysis.” Management usually has the best insight into the best transactions in the market and is usually the one best resource BUT it’s the investment banker’s job to figure this out on their own.

- You do a run using bank resources that search and screen for relevant criteria you input.

You will never find a perfect precedent transaction because no company is ever 100% similar but you will be able to narrow down your search using the following characteristics for the target company:

- Sector

- Products & Services

- Customer

- Distribution Channel

- Geography

Step 2: Locating the Necessary Financials

Once you have your universe of precedent transactions in your industry, the next step is finding the necessary financials that will be used to spread your multiples. The best way to dig up the amount paid during these transactions is to pull the information either in the deal press release or SEC prospectus that is filed online at sec.gov. Sometimes bankers will use databases such as Capital IQ or Factset when pulling these “deal multiples,” but it is always best to check these with the original filings.

Usually necessary financials include the following information:

- Total deal amount paid by the acquiror: this will be your enterprise value

- Target Company Earnings per Share (EPS)

- Target Company Market Capitalization (Deal Amount – Net Debt)

- Target Company Earnings before Interest, Taxes, Depreciation, and Amortization (EBITDA)

- Target Company Total Revenue

There is no better source than using public filings on sec.gov. This will take longer pulling this information by hand vs. a database but it’s the best way.

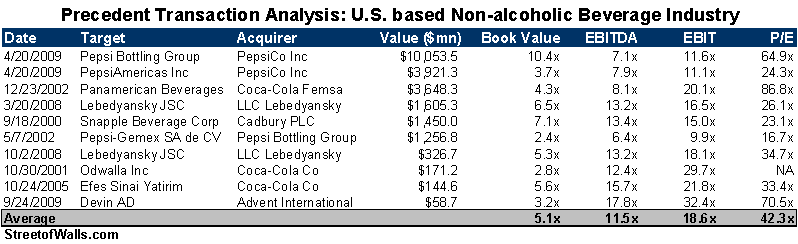

Step 3: Spreading the Key Trading Multiples

The next step after collecting your universe of historical transactions and locating the necessary financials is to start “spreading” (banker lingo) the key deal multiples.

You will be analyzing comparable multiples such as:

- Enterprise Value / Sales

- Enterprise Value / EBITDA

- Stock Price / EPS

- Market Cap / Book Value

Exhibit taken from the IB Total Interview Guide:

Step 4: Determining Valuation

The final step once you have spread the multiples for your custom universe is to use this information for determining valuation. Using the information in step 3 above, you will use the financial multiples of your universe to determine the valuation of your company.

For example, if your company is predicting to have EBITDA of $200 million in 2010 and the precedent transaction analysis is showing target companies were purchased for 10x EBITDA then your company would be worth approximately $2 billion.

Other interesting articles: