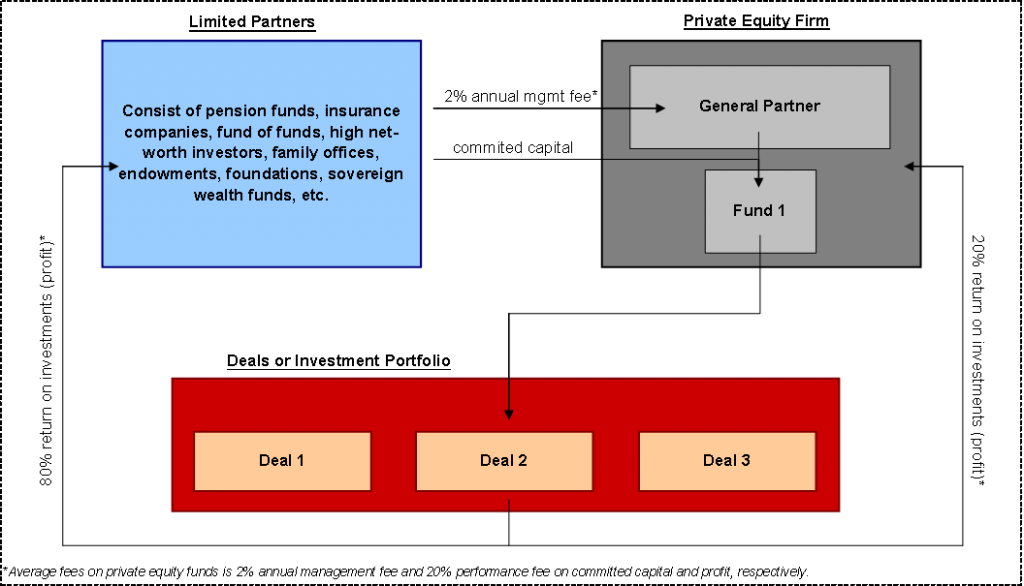

A private equity firm is called a general partner (GP) and its investors that commit capital are called limited partners (LPs). Limited partners generally consist of pension funds, institutional accounts and wealthy individuals.

The general partner invests the fund’s committed capital in public and private companies, manages the portfolio of investments and seeks to exit the investments in the future for sizable returns. A general partner may manage one or a few funds that may have different investment restrictions such as geography, industry or typical size of each investment.

Each fund generally makes 10 to 12 investments and the life of a fund is usually 5 to 7 years. As a general partner’s funds become almost fully invested, the firm will need to plan future fundraising to raise new funds using its proven track record of success in previous funds.

Exhibit taken from Private Equity Interview Guide:

General partners generally charge both a management fee and a performance fee. While this varies by firm and its funds, typical management fees consist of 2% of assets under management and performance fees of 20% which are taken from exited investments. Performance fees are also called “carried interest” or “carry”.

In a few instances, there is a hurdle rate which is a % return (typically 8-10%) that LPs must receive before performance fees can be received by the general partner. Performance fees motivate the private equity firms to generate superior realized returns. These fees are intended to align the interests of the general partner and its LPs.