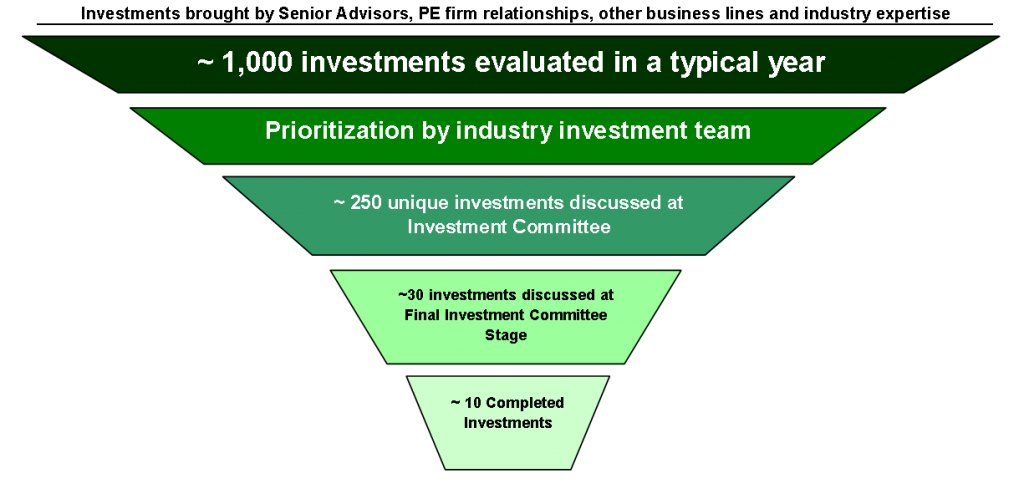

When I was a pre-MBA associate at a private equity firm that focused on growth capital and leveraged buyout opportunities, I learned that the private equity deal process varies greatly from the deal process when viewed by an investment banker or from other sell-side positions. Through the first year, the investment team evaluated over 1,000 opportunities and we completed roughly 5 transactions.

Investment banking and consulting analysts need to be ready for a very thoughtful and selective investment process that is almost the opposite of working at a hedge fund, where you can be in and out of a stock investment in just a few days.

Here is a basic diagram that explains how the investment process typically works at a basic private equity firm:

A deal that goes from a teaser to a completed transaction has many steps. First, the opportunity enters the door as a “teaser” and is handed to the appropriate investment team. For example, an opportunity to acquire Sprint through an LBO would go to the related telecom and technology investment team. This “teaser” contains basic information of the company without giving away the actual company name. So the Sprint deal would say something like this: “A telecom company has hired X investment bank to provide strategic alternatives to the company, including a full sale of the business.” If the teaser seems interesting and complies with the private equity fund’s investment criteria, the private equity investment team will sign a non-disclosure agreement and will receive more information on the company, including the name.

As the diligence process continues to evolve, the investment may be brought to the private equity firm’s investment committee several times until a final decision is made either to complete the transaction or to end the transaction process and move on to other more interesting opportunities. There are a few rounds of negotiations between the seller and the private equity firm during the process. The entire process can take anywhere from one month to a year, depending on the investment circumstances. For example, a company may be distressed and need immediate capital to rollover maturing debt to a company that has strong cash flows and is in no rush to receive a buyout offer.

Reasons that more deals don’t progress to later stages of the investment process can include company or industry fundamental issues, a large valuation gap between buyer and seller, low IRR and lack of an attractive exit opportunity.