Private equity funds occasionally liquidate or sell illiquid private equity investments via secondary transactions to a secondary private equity fund. These secondary private equity funds help private equity investors of all sizes address their liquidity and portfolio management needs. This secondary private equity market is considered the buying and selling of unrealized investor commitments to another private equity fund. Limited partners receive liquidity in this way as their interest is transferred to the secondary buyer. This market is not as institutionalized as the primary private equity market. However, there has been a growing amount of interest in the secondary market as private equity funds diversify their strategies.

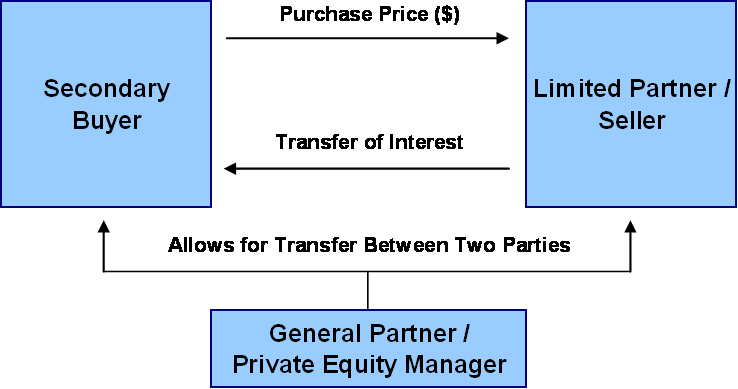

A few names of private equity firms that are dedicated to the secondary market include AlpInvest Partners, AXA Private Equity, Coller Capital, Lexington Partners, Newbury Partners and HarbourVest Partners. A typical secondary transaction would resemble the following for a transfer of limited partner interest:

A few examples of secondary transactions that occurred throughout 2010 include the following:

– Secondary firm Lexington Partners has agreed to purchase a private equity fund portfolio worth about £470m from Lloyds Banking Group, according to a release issued by the firm

– Citigroup agreed to sell about $900 million of private equity investments to Lexington Partners

– AXA Private Equity acquires $1.9 billion portfolio of private equity funds from Bank of America

In summary, secondary investments provide the following:

– Ability to sell illiquid assets

– Obtain cash and liquidity to limited partners

– Transfer obligations to fund commitments from a limited partner to a secondary private equity firm

– Eliminate or reduce managerial task and overhead costs

– Reallocate assets into new areas as the investment objections evolve