Understanding Whether you are Core or Non-Core

There are two separate interview processes that the investment banks run: one for internships, and one for full time recruiting. This is true for both analyst and associate hiring. Figuring out where you fit into this interview process is extremely important—many banking candidates are not aware of the nuances.

Generally, the largest investment banks are the ones with the most structured interview processes—they have a thorough and rigid recruiting game plan each year. This differs from smaller Boutiques, which will usually hire more on an as-needed basis because they don’t have the predictable deal flow nor the financial and human resources to implement a structured recruiting program each year. The investment banking recruiting process at larger banks is typically divided up between “core” and “non-core” college recruiting (sometimes called “target” and “non-target”). Banks have a certain number of core (target) schools at which they interview on-campus each year; they typically allocate a certain number of job slots from each school for their incoming analyst and associate classes.

Whatever is leftover after “core” interviewing constitutes the “non-core” recruiting; this process typically trails core interviewing by a few months. Thus, for example, if you go to Penn State you will have a much different interview process than a job candidate from Wharton, because you will be recruiting for one of the non-core slots in the incoming analyst class (or associate class for incoming MBA students).

The makeup of recruiting from “core” schools always differs by bank, but it will typically include recruiting from the top 10-15 business and liberal arts schools in the country. Thus Harvard and the University of Pennsylvania (Wharton) will always be core schools while Indiana University and UCLA will always be non-core.

Non-core recruiting is conducted differently. Most candidates are introduced to the process via internal referrals and, to a lesser extent, online applications. It is a good rule of thumb that if you are a non-core candidate without an internal referral, it will be very tough to ever get noticed. Investment banks will receive tens of thousands of resumes every year with hundreds of internal referrals. Because their time and resources are finite, most of these candidates will not even get a first glance, let alone a second one.

Now, compare this to the number of job slots: a typical Bulge Bracket investment bank generally hires about 60-80 first-year analysts every year, with a majority being internship hires and students from core/target schools. It is estimated that roughly 900 first-year analysts are hired every year in the U.S., with a majority of these coming from the Bulge Bracket banks. As you can see, the odds are stacked against all of the candidates — but especially against the non-core ones. While the process to get noticed and do well is very challenging, it can be done. This Chapter can teach you how.

Breaking Down Core Recruiting

Again, core recruiting (also called target recruiting) refers to investment banking recruiting where the banks will visit your school for on-campus recruitment. These schools are the backbone of the hiring process and generally makeup roughly 70% of total hiring for analyst and associate programs for Bulge Bracket banks.

Core recruiting is a very structured process and it is really important for you to understand how this process works, if you are a candidate from a core/target school. Later in this training program we will discuss dates and deadlines, but for now let’s focus on how the overall process works. Generally, the core recruiting process is done in 3 steps. (Steps 4 and 5 are strictly on the candidate side and don’t directly affect the banks themselves.)

STEP 1: SUBMITTING RESUME / INFORMATION SESSIONS

The first step is applying online via the college’s Career Resources Center (CRC) and/or the individuals banks’ websites. Make sure you are checking the dates/deadlines on the school’s CRC website, because the online application process will often close weeks before interviews actually begin! The investment banks will then bundle up the collected resumes into a book and send them around for current investment banking employees at the bank to peruse (usually 1st and 2nd year analysts). Also, banks will often host information sessions on college campuses a month or two before interviewing starts. The information sessions typically only last for a few hours but it gives candidates an opportunity to learn more about the firm and network with a few professionals at the firm. These information sessions provide candidates a great opportunity to stand out. Come prepared to these sessions with thoughtful questions and make sure to follow-up with thank you emails.

STEP 2: ON-CAMPUS INTERVIEW

Interviewees are then selected for on-campus interviews based on feedback from the information sessions and their resumes. The investment banks will work with the school’s CRC to schedule a time to interview accepted candidates on-campus. These generally consist of 30-45 minute interview slots, where candidates will meet with 1-2 investment bankers (usually Associates and VPs). There will be both behavioral and technical questions asked — so make sure to prepare for classic investment banking interview questions beforehand.

STEP 3: SUPERDAY

The third step in the core recruiting process is called a “Superday” (or something similar). A Superday will typically be your final round of interviews, and it can be grueling. It will occur on-site at the bank, and it usually lasts from about 8am to 6pm with as many as 8-12 interviews. At the bare minimum, you will meet with at least one analyst, one associate, one VP and one MD. Plus, there will be interviews with 4-8 others of various groups/ranks within the firm. Each of these interviews will generally last for 30-45 minutes. There is no “standard” interview format: some candidates might get all behavioral questions and some might get all technical questions, so be prepared for either!

STEP 4: THANK-YOU NOTES

It is essential to send a “thank-you” note to everyone you meet with on your Superday. This will not “make or break” your offer — decisions are made very quickly and a thank-you note most likely will have little impact — but it helps to develop that relationship and demonstrate respect for the bankers’ time. If you get the offer and work with them, it can enhance the working relationship and even if you do not, it can help foster an ongoing networking relationship with an individual that could be helpful down the line.

STEP 5: HEARING BACK

This is the easy part. If you are getting a job offer, you will generally hear back almost immediately (either on Superday or on the following day). If you don’t hear back immediately it doesn’t necessarily mean you didn’t get the offer – sometimes it can take a few days – but as each day passes the odds of an offer coming decrease quite a bit. If you haven’t heard back within 4-5 days feel free to send the bankers that you met a follow-up thank-you email reaffirming your interest in the position – but at that point, recognize that it’s become a long-shot at best.

HOW TO PREPARE FOR INVESTMENT BANKING INTERVIEWS

What is listed above is only a fraction of what you need to know for investment banking interviews. Having been through the process and understanding how this process works, Street of Walls has developed comprehensive guides to help with the more detailed, technical aspects of what you should know for your investment banking interviews. In particular, be sure to see the Investment Banking Technical Guide for further information on what can be covered in a banking interview.

Breaking Down Non-Core Recruiting

As we’ve established, there are over 3,000 colleges and universities in the United States alone, and only a select few of these schools fall into what investment banks call the “Core Recruiting Process.” These are typically the top Ivy League universities and business schools that are “Target Schools” for the top investment banks. If you do not fall into this category, your odds do become harder, but do not get discouraged: investment banks have established a process designed for top-talent candidates coming from other schools. This is called the “Non-Core Process.”

As you might expect, this process is extremely difficult as candidates are interviewing for only a few available positions and are competing against candidates from every other non-core college or university in the country (not to mention the fact that students who go through core recruiting can also participate in the non-core process).

Team members at Street of Walls have personally gone through this non-core recruiting process and have succeeded. The purpose of this section is to detail how we did it and how you can as well.

Landing the Non-Core Interview

Landing the first-round interview is the first major goal in the “Non-Core Recruiting Process” and, given the volume of applicants, quite possibly the hardest goal to accomplish. Every year, Street of Walls sees non-core undergrads who possess the necessary talent but who will never get the chance to demonstrate it at an investment bank. It is possible to put in months of intense preparation for the interviewing process in banking, only to discover that you never even got the opportunity to show off your skills. This is why it is essential to be not only as prepared as possible, but also as connected as possible. Candidates who have connections in the field are far more likely to get a chance to interview with investment banks.

The first step in the process is to apply online for investment banking positions. This is a prerequisite for every potential candidate. After you apply online, you will have your own personal login, so that you can post your current resume and update information as it changes. Typically, investment bankers are very focused on resumes—they will check your resume for proper formatting and content. Investment bankers format Pitch Books on a daily basis, so even the slightest formatting error could raise a red flag to your attention to detail. Therefore, the need is clear: make sure your resume is excellent. If you haven’t already done so, please visit the Street of Walls article on building the perfect investment banking resume.

These days, with top job opportunities becoming intensely competitive, applying online with a great resume, stellar GPA, and good work experience is not enough to ensure an interview. You will often need some internal help. Generally, the best way for a non-core candidate to land a first round interview is by having an employee at the bank refer your resume to the Human Resources department. The higher up the employee, the better your chances of actually landing an interview. Now, you might be thinking to yourself: “But I don’t know anybody in investment banking.” If this is the case, the following concept is extremely important.

Networking is a key to success for non-core applicants. Typically, university alumni are great people to get in touch with for this. Work with your school’s alumni network to find contacts that currently work in investment banking. Don’t stop there though; get in touch with every family friend, relative, or friend-of-friend you know and see whether they know anybody that works in investment banking that you might speak with. As soon as you feel that you have a good base of contacts, send out emails to everyone asking if they wouldn’t mind speaking over the phone about their job, experience in investment banking, and how the recruiting process at their bank works. Most people are more than happy to speak over the phone with someone looking for assistance in the process, especially if they believe that person is serious about the industry and could be a good candidate for it.

Here is a good example/template for an email to help get you in a door with an associate at a bank:

Dear John,

My name is Jack and I am currently a Finance major at Penn State University. I am eager to learn about the investment banking industry. I received your information from our alumni directory and would love to speak with you regarding the Bank of America Merrill Lynch Summer Analyst Program. It would also be great if I could hear your perspective on the investment banking industry and your experience at the firm. Would you be available to either have coffee or speak over the phone for 15-20 minutes? As a fellow Nittany Lion, I would really appreciate your help. Thank you, and I look forward to hearing back from you.

Regards,

Jack

Penn State University

Phone: (XXX) XXX-XXX

Email: jack@email.com

This next and final step is the most crucial to receiving an appropriate referral in the non-core recruiting process. During your calls with bankers, if you feel like the call is going well, you should politely ask whether they would mind referring your resume to Human Resources. This question is greatly dependent on how well the phone call is going. Most people will not refer just anybody for these positions—they have to feel that you are a strong candidate, and that you would fit well within the position and the firm as a whole. When an employee refers a potential candidate, it makes them look bad if the candidate gets an interview and ends up doing poorly. That being said, if your conversation is going well and you feel that the banker you are talking to truly wants to help you out, you should politely ask for a referral as demonstrated above.

I personally received 5 employee referrals at different investment banks during my recruiting process, and I ended up receiving first round interviews at 4 out of the 5 banks. Experience has confirmed that employee referrals are easily the best way to receive a first round interview, and if you can follow these steps I have no doubt that you will successfully land a first round interview, just as I did.

If all goes well, carefully executing these steps will lead to a First Round Phone Interview. Much of this process can be learned, and I will guide you through each component.

First Round: Phone Interview

The Investment Banking Phone Interview is the second phase of the Non-Core Recruiting Process. Congratulations if you have landed a first round interview as it is the most difficult part of the non-core interview process. You should now feel more confident, because your resume was selected from among thousands of other hopefuls.

The next step is being successful in your first-round phone interview. Phone interviews are done for both internship recruiting and full-time recruiting—all candidates will have to go through them, with the exception of core recruiting candidates who typically meet with the bankers on-campus for first rounds.

So how does one do well in them? It’s quite simple: preparation, preparation, and more preparation. If you are entirely ready for the questions that will be asked, you should do very well. We at Street of Walls know these questions well, and they will help you stand out in the process; they will be discussed in a moment.

Phone interviews are generally conducted by Associates and Vice Presidents within the bank. What usually happens is that the Human Resources department will give the banker 5 to 7 resumes and will tell him/her to rank the people he/she speaks with from best to worst. Typically, only the top 1-2 people on the list will go on to Final Round interviews (Superdays). Their primary goal is to reject candidates who are unlikely to fit the needs of the job, because they are unprepared, do not have the right personality, or aren’t serious about investment banking.

The First Round is generally less technical than the Final Round (Superdays), and is primarily used to gauge the personality and cultural fit of potential candidates. If the candidate can hold a casual conversation with the interviewer while simultaneously showing that he or she wants the job more than other candidates, he or she will do very well.

Here is a sample of questions that interviewers are very likely to ask in First Round (phone) interviews. A more detailed review of investment banking behavioral questions are described in Chapter 7.

Typical Phone Interview Questions:

- Tell me about yourself.

- Why do you want to be an Investment Banker?

- Why do you want to work at this Investment Bank?

- Tell me about the classes you are taking. What are your favorite and least favorite classes?

- What are your biggest strengths and weaknesses?

- Walk me through a Discounted Cash Flow analysis (DCF).

- What are the different valuation techniques?

- Walk me through the major sections or line items of an Income Statement, a Balance Sheet, and/or a Statement of Cash Flows.

One very successful technique for preparing for the First Round interview is to make use of mock interviews. Ask a friend or, if possible, an employee at your school’s Career Resource Center to help you answer the questions listed above. Your answers can sound very different in your head than when you actually verbalize them in front of someone else. Again, the process of improvement involves preparation, preparation, and more preparation. Go through these mock interview multiple times; identify where you are performing strongly and where you need to work on your responses; and do them again and again. Once you feel confident in your ability to verbalize these answers, you are close to being fully ready for your First Round phone interview.

The general rule of thumb in a first round investment banking phone interview is that you cannot stumble on any of the technical interview questions that arise. The technical questions in a first-round interview usually aren’t the most difficult, but you still should be prepared to answer anything. Bankers generally like to ask these questions to gauge that you have done your homework — if you stumble on these questions, the banker is very likely to assume that you haven’t prepared properly, and is likely to terminate your process with the bank right there. I went through dozens of phone interviews and kept finding myself making small cheat sheets for questions that might be asked. I have compiled my work into the Phone Interview Cheat Sheet found in this manual. I’ve handed this down to close friends and family who have landed full-time investment banking jobs, and all of them have said that it helped tremendously in their interviews—especially the phone interview.

Assuming that you succeed in the phone interview round and make it on to the next round, you will go on to the on-site Superday round of interviews, at the investment bank itself. These interviews will contain a much broader set of questions and topics; all of these will be covered later in this guide.

Also, after your phone interview be sure to follow-up with a thank-you letter to the recruiter. You will generally hear back regarding your phone interview within 2 weeks, and even sometimes within days. In this case it does pay to send the thank you letter as soon as possible, as they are likely to receive it before you hear back on the results of the phone interview round.

Phone Interview Cheat Sheet

First-round phone interviews are generally very predictable, and because they are conducted over the telephone, the interviewer will not be able to tell that you’re referring to reference materials while responding. Thus it makes sense to have this sheet available during the call:

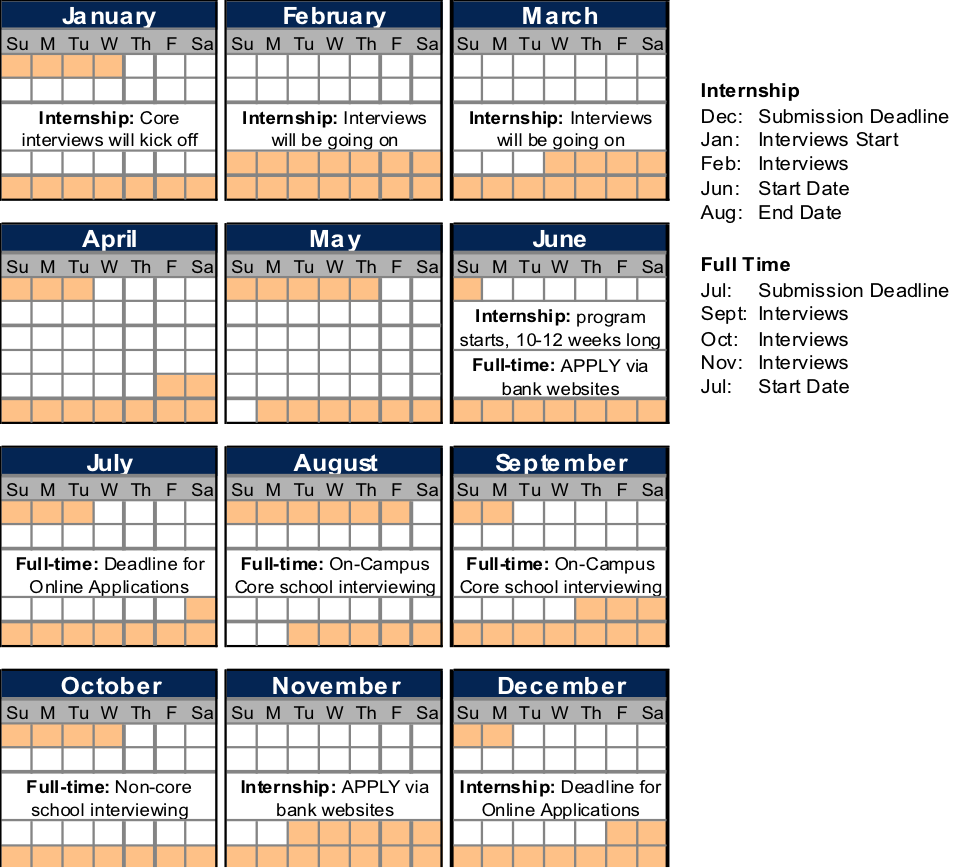

Dates and Deadlines for Investment Banking Interviews

The investment banking recruiting cycle differs by bank, but interviews generally occur at roughly the same time every year. If you miss the deadlines even by a few hours, this will ruin your chances of interviewing at the bank for that year.

Full-Time Interviews

First, let’s understand when everyone comes on-board. Full-time analysts start their career in the months of June and July and go through a two-month training program learning the basics of financial modeling, financial statements, PowerPoint and Excel features.

Full time interviews for the next year will generally kick off around August until October for both undergraduate and graduate students. Full time interviewing differs by school, so figuring out whether you’re a “Core” or “Non-Core” candidate will be beneficial here.

Internship Interviews

Interns (also called summer analysts) will come on-board during June for a 10-12 week program. Internship training programs will generally last one week prior to start. During the last week of the summer internship program, the banks will hand out full-time offers for next year to the candidates who they feel will make a good contribution to the team. Generally this is a majority of the interns (80-90%), although there will always be some who do not make the cut.

Internship interviews will generally start in January and continue into February for both undergraduate and graduate students. Depending on where you fit within the interview cycle, you will either be interviewing on-campus or through a first-round phone interview.

Off-Cycle Recruiting

The smaller boutiques and middle market investment banks usually have a less structured interview process in terms of guidelines and dates. Boutiques in particular will usually hire on a need-only basis, so interviewing at these firms can happen throughout the year. If you find yourself behind the calendar in terms of preparedness, I suggest targeting the boutique and middle market investment banks rather than trying to break into the Bulge Bracket bank interview processes, which will likely be completely unsuccessful.

How to Pick Your Group & What That Means

Determining which group to join within the investment bank can be very important. For those who have the luxury to worry about this issue, it is critical that you put some thought into your decision. Picking the wrong group can really pigeonhole you into specific exit opportunities. Thus if you do not consider where you’d like to be when you finish the analyst program, you may end up on a path that cannot lead you to your destination. Be prepared to think this issue through completely.

Banks all choose their teams differently. At some banks, team assignments are given out directly after training, while others allow you to rank your group preferences so that a matching system can be performed. Nowadays, most bank hiring is done through some type of internal referral from an employee; this referral can often have a lot of weight in your group decision. For example, if you were a candidate referral from a VP in Healthcare, then it will be much easier to request that group and wind up in that group. If you are a returning summer analyst, you are very likely to already pinned to that group when you return (unless you have worked out specific alternative arrangements). Some investment banks allow summer analysts that have received full-time offers to interview with different groups if there are spots available.

Investment banking groups are divided among product and industry groups. Most industry groups will source (initiate) deal flow, and the corresponding product group will team up with the industry group mid-process to help execute those deals/transactions. This figure gives a quick snapshot of the different investment banking groups typical in a bulge bracket bank:

Picking the right group is a function of which bank you will be working for, and your long-term goals. Banks will always have groups that have a better reputation than others, and those groups are usually the most sought-after by incoming analysts and associates. These groups usually have the best reputation for placing candidates on the buy-side, because of their high deal-flow and well-known Managing Director relationships.

For example, the Technology, Media, and Telecommunications (TMT) group at Goldman Sachs is one of the most popular groups at Goldman Sachs. But what makes this group so special? The answer is simply the group’s deal flow, which results from the group’s reputation in Corporate America. Goldman’s TMT group generally is involved with almost all of the largest technology deals that go through the market. Among corporate executives in the sector, the group is considered the go-to place for technology-related M&A and equity underwriting. If you are a technology-focused Private Equity firm or Hedge Fund, this group is probably at the top of your list for candidate recruiting: these analysts will have the most in-depth technology investment banking experience on Wall Street.

That said, you shouldn’t let the prestige of the specific banking group be your sole reason for applying to that group. Investment banking is often used as an analyst stepping stone into buy-side opportunities in Hedge Funds, Venture Capital firms, and Private Equity firms. Usually these buy-side firms like to hire analysts with experience in the same industry in which they invest. If you have a target industry you would like to work in after investment banking, you should strongly consider working in that group while in banking—even if it’s not among the bank’s highest-reputation groups.

To make this more concrete, let’s assume an Industrials-focused Private Equity firm wants to hire analysts or associates. This firm will usually want to first look at Global Industrials Group (GIG) investment banking analysts. By contrast, some HF/VC/PE investors (often referred to collectively as “buy-side firms” or “the buy-side”) are fairly broad-based, but others, like those investing in Energy or Financial companies, are very specific. They will almost certainly want analysts from these groups in Investment Banking. Conversely, if you are in one of these industry groups, you will tend to learn a different type of financial modeling than if you were in other groups, and will therefore be much less attractive as a candidate to HF/VC/PE funds that do not invest in these industries. In these specific industry areas, the financial modeling techniques used will be “industry-specific” models. For instance, banks don’t report “revenue” or “sales” in their income statement but have a line item called “Net Interest Income” which represents the yield made on loan underwriting. Extensive financial modeling experience involving companies with this Income Statement arrangement will be highly attractive to a Financials-focused hedge fund, but could really cause problems in your buy-side interviewing efforts for non Financials-based buy-side firms. This is because your skill set will be very deep but also very specific to one industry, and therefore not easily transferable to generalist investment funds.

Therefore there is no simple formula to determine which group(s) you should apply to, but it’s important to be aware of the factors we’ve discussed:

- Group Prestige: Is the group well known at the bank? Does the group receive substantial deal flow?

- Culture & Senior Bankers: Will the group be a good work environment? Have you met the bankers in the group and think you would enjoy working with them?

- Exit Opportunities: Is the experience you will be gaining within the group broad or industry (or product) specific? If so, is this a field you are highly interested in?

One final thought on group selection: it should be noted that smaller boutique and middle-market banks will not always have this many groups; small boutiques, for example, might only have one group or a small handful of groups in place. In that case, all bankers will be generalists to some degree, covering many or all industries and sectors.

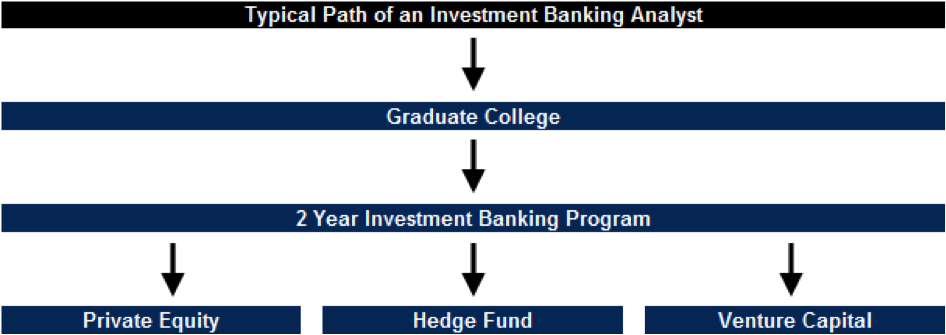

How Your Group Impacts Exit Opportunities

Analysts are hired for a two-year program with a select few (generally those considered to be at the top of their class) receiving third year analyst offers. From there, there will occasionally be Associate offers (this track is appropriate for individuals who want to become career investment bankers), although this is somewhat uncommon. The typical route for an associate is a candidate placed post their MBA program and not an Analyst that was directly promoted. Note, Goldman is one exception, as they are now encouraging analysts to stay on post their second year by offering direct promotions to Associate at the beginning of their third year. However, Goldman is the only major bank that does this at the moment.

Therefore, by and large, the post-analyst position opportunities will entail leaving the investment bank. There are two very popular external exit routes for an investment banker: Private Equity firms and Hedge Funds. Both types of entities perform similar functions: they take investor money and try to earn above-average risk-adjusted returns through alternative investment strategies (by alternative, broadly we mean “different from what typical public equities investors do”).

Private equity investing is a much more transaction-based discipline, and in many ways the work is similar to that which an investment banking M&A group performs. Private equity funds aim to earn a superior return by acquiring controlling interests in companies and holding them privately (as opposed to publicly, as in, publicly listed or traded). By contrast, most Hedge Funds invest in publicly traded securities, so the analyst or associate’s due diligence process in making an investment is much shorter. This is particularly true for funds that do “fundamental”-style investing or event-driven investing. While a Hedge Fund work is not transaction-based like Investment Banking or Private Equity, it does require a great deal of fundamental analysis and valuation work, and it requires a high level of investment acumen and intellectual rigor.

Other popular exit opportunities after investment banking include Venture Capital, Equity Research, and Business Development at a company. Also, many investment bankers immediately go to business school upon completing the two-year analyst program. Some even might start their own companies.

Calendar of US Investment Banking Recruiting

Full-Time: Generally August or September is when Full-time interviewing for core undergraduate and graduate students. October is a typical starting month for non-core student recruiting.

Internships: Generally January kicks off summer internship interviews for undergraduate and graduate students.

The figure below illustrates a typical calendar of key dates in the beginning of the investment banking recruiting cycle.

Off-Cycle: Middle-Market & Boutique

The smaller the bank, usually the less structured the interview process will typically be (in terms of set guidelines and dates). Boutiques in particular will usually hire on a need basis, so interviewing can happen all year around. Most of the boutiques will interview full-time in the spring (there as much as 3-5 months after the big banks).

Can’t get a job?

If you are caught outside of the typical recruitment cycle without a job, visit Street of Walls and get a hold of the middle-market and boutique investment banking list. These firms will be more likely to recruit off-cycle as opposed to within a structured interview process, so your chances will be much better.

What to Wear to an Interview

Always wear a full suit to an interview. Street of Walls suggests going out and getting at least two good suits – you’ll need them. Looking good for your interview really does make a difference. In other environments it isn’t as important, but for investment banking, appearances do matter, so look sharp. Ultimately, the goal is to look professional (i.e. presentable to a client) but not flashy or over-the-top.

Men: Style & Colors

- Suit: Wear a solid colored suit, either dark grey, dark blue or black. Classy but conservative is the name of the game.

- Shirts: Wear solid shirts as well, white or light blue. No French cuffs.

- Tie: Wear something conservative (i.e. not a red power tie).

- Shoes: Black cap-toes are the classic banker look.

Men: Suggestions on Brands

- Suit: Zegna (expensive but good), Hickey Freeman, Hugo Boss, Brooks Brothers

- Shirts: Brooks Brothers, Charles Tyrwhitt, Bloomingdales, Macy’s

- Tie: Brooks Brothers, Charles Tyrwhitt, Vineyard Vines, Zegna, Hickey Freeman, Ferragamo

- Belts: Brooks Brothers or similar

- Shoes: Allen Edmonds, Cole Haan, Salvatore Ferragamo

Women: Style & Colors

- Wear a conservative suit, generally either navy, dark grey or black

- If wearing a skirt suit, do not wear a tight nor revealing one

- Button-down shirt of a solid, light color

- Be conservative with respect to makeup and perfume

Women – Suggestions on Brands/Shopping

- J. Crew

- Banana Republic

- Zara

- Bloomingdale’s

- Macy’s

Very important: No French cuffs. No pocket squares. No cut-back collars. These looks are not conservative, and may clash with the interviewer’s sensibilities.

←Investment Banking AnalystInvestment Banking Networking→