During a private equity interview, analyst and associate interview candidates may be asked to build an LBO model at various stages of the interview process. Therefore, a well-prepared interview candidate must be able to successfully complete any variation of a LBO model prior to his or her interview process.

Leveraged Buyouts: Basic Overview

A leveraged buyout is the acquisition of a public or private company with a significant amount of borrowed funds. A private equity firm (or group of private equity firms) acquires a company using debt instruments as the majority of the purchase price. After the purchase of the company, the debt/equity ratio is generally greater than 1.0x (debt generally constitutes 50-80% of the purchase price). During the ownership of the company, the company’s cash flow is used to service and pay down the outstanding debt. The overall return realized by the investors in an LBO is determined by the exit cash flow of the company (EBIT or EBITDA), the exit multiple (of EBIT or EBITDA), and the amount of debt that has been paid off over the time horizon of the investment. Companies of all sizes and industries can be targets of leveraged buyout transactions, although certain types of businesses, as discussed earlier, make better LBO targets than others.

- Determining a fair valuation for a company (including an ability-to-pay analysis)

- Determining the equity returns (through IRR calculations) that can be achieved if a company is taken private, grown, and ultimately sold or taken public

- Determining the effect of recapitalizing the company through issuance of debt to replace equity

- Determining the debt service limitations of a company from its cash flows

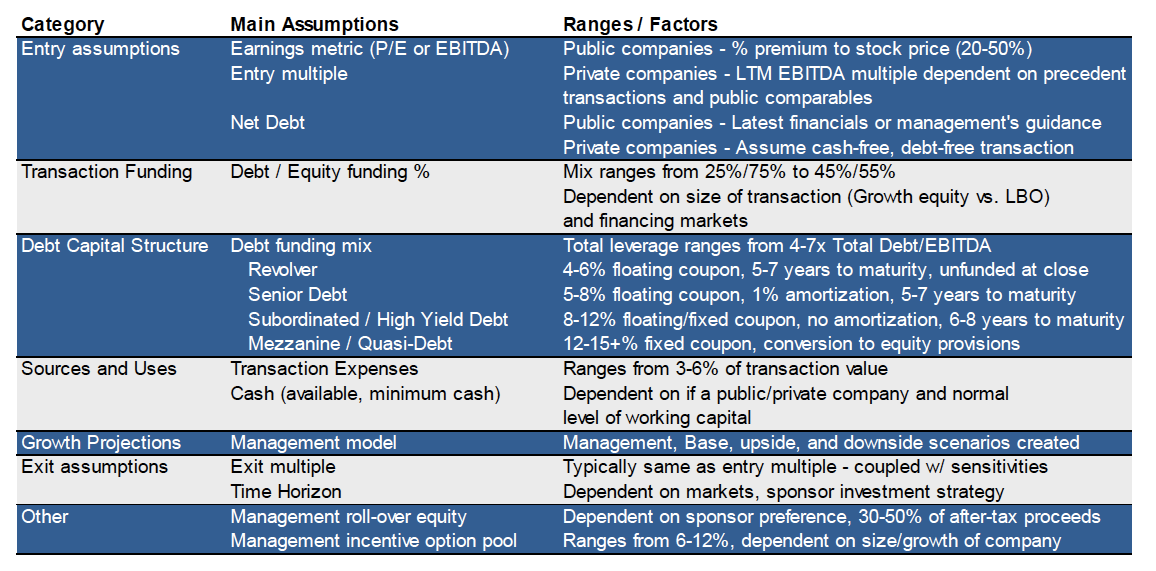

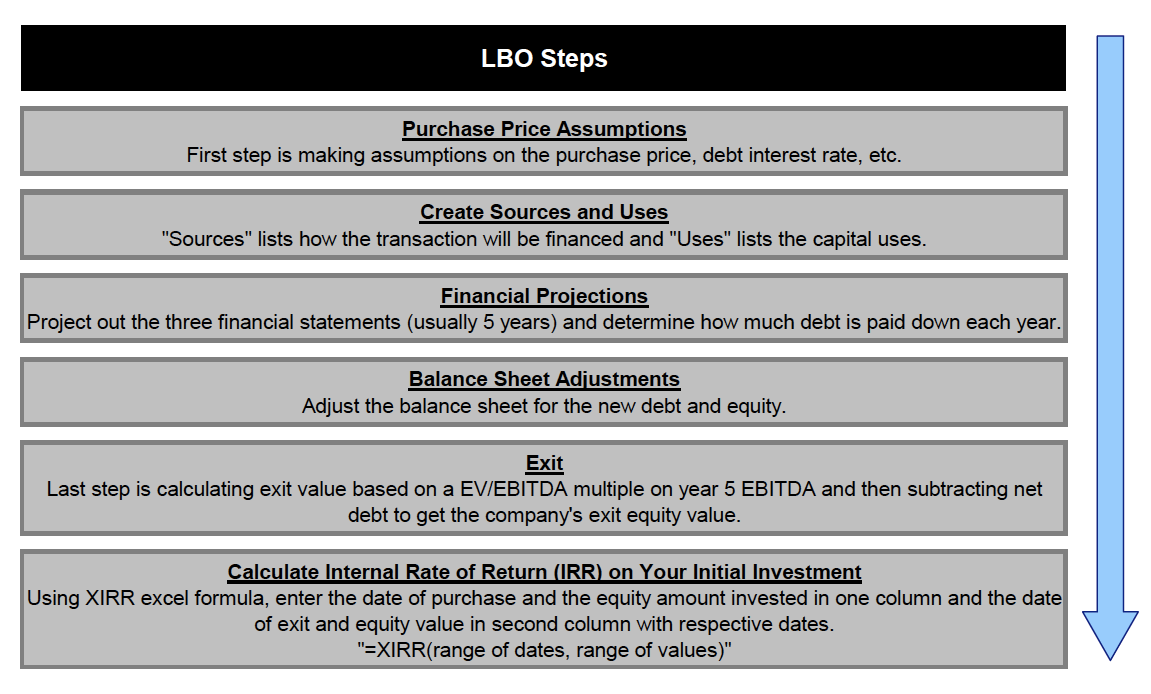

In order to prepare for an LBO modeling test, the first step is to understand the key assumptions and the process. These are provided in the tables below:

In order to correctly complete the test, you must understand the basic assumptions and steps to create an LBO because most modeling tests will only provide a few of the assumptions you will need. You will need to make other basic assumptions based on what you know about the private equity firm you’re interviewing with, and use that to create the model. To make the accurate assumptions, you will have to understand the types of companies the sponsor likes to invest in and their investment strategy, such as the purchase price, capital structure, growth and margin assumptions, and exit strategy. Whenever you have to make assumptions that are not given or standard, document the assumptions that you make and be prepared to defend them.

To prepare for this test, practice creating the different types of LBO tests you may receive from scratch (paper LBOs, short-form excel LBOs, long-form detailed 3-statement LBOs). This will help you become more familiar with modeling, but it also will give you a better idea of how an LBO works. For example, one of your goals should be to comprehend how an investment’s IRR is affected if you adjust the values of key levers such as the purchase price, the amount of leverage, revenue growth rates, and the exit multiple. This is especially important for investment banking analysts and consultants who haven’t had a lot of exposure to LBO modeling. The more you practice these tests, the more prepared you’ll be, so spend as much time on this as you can.

In the following chapters, we will walk through variations of an LBO modeling test and case study.

←Private Equity InterviewPaper LBO Model Example→