A hedge fund is a regulated investment fund that is typically open to a limited range of investors who pay a performance fee to the fund’s investment manager. As we will discuss below, every hedge fund has its own investment philosophy that determines the type of investments made and strategies employed. In general, the hedge fund community undertakes a much wider range of investment and trading activities than traditional long-only investment funds (mutual funds, asset managers, etc.). Hedge funds invest in a broader range of assets, including long and short positions in equity, bonds, commodities, and derivatives.

Hedge Fund History

Hedging out unwanted risk has been a common activity in the financial markets for centuries. In the 1800s, for example, commodity producers and merchants started using forward contracts to protect themselves against futures changes in commodity prices—these contracts hedged out the risk of adverse market fluctuations beyond their control. Such forward contracts are still traded to this day in the futures market.

Alfred Jones is credited with the creation of the term “Hedge Fund” in 1949. He created A.W. Jones, a partnership with four friends, and through this vehicle he invested $100,000 in stocks, using both long and short positions. During the first year, the fund returned 17.3%. The idea has caught fire since.

Hedge funds were later popularized by the likes of managers such as Julian Robertson and George Soros. They have been trading since the mid-1980s, generally outperforming the markets, and making excellent returns with substantially less volatility than long-only investments in risky assets classes such as equities. In 1992, Soros’ Quantum Investment Fund rattled the markets when it bet $1 billion on the devaluation of the British pound. The U.K. estimated that this cost Britain about $6 billion, driving Britain to pull out of the Exchange Rate Mechanism and spiking interest rates. Needless to say, Quantum made a killing on this position!

Hedge Fund Industry Size

Since 2008, Assets Under Management (AUM) have sharply fallen due to the credit crunch, trading losses, and withdrawal of assets from hedge funds by investors (i.e., redemptions). Still, it is estimated that the hedge fund industry, currently consisting of approximately 8,000-10,000 hedge funds, manages close to $2 trillion in the United States alone.

Largest Hedge Fund Managers

As of December 2009, the largest 25 hedge fund managers had $520 billion in assets under management. Some of these include Bridgewater Associates, Paulson & Co., and Soros Fund Management.

Hedge Fund Fees

Hedge funds make money by charging both a management fee and a performance fee. While this varies by fund, typical management fees constitute 1-2% of assets under management annually, while performance fees generally are 20% of gross profits returned by the fund, subject to certain constraints. The performance fee is the defining characteristic of a hedge fund: it motivates the hedge fund manager to generate superior returns, and it is intended to align the interests of the manager and investors more than the flat fees typically associated with long-only fund managers. To put it simply, hedge fund managers get rich if it generates superior returns, thereby making their clients rich.

Hedge Funds vs. Mutual Funds

- Hedge fund investors must be accredited (meaning they must have a certain amount of liquid assets and a certain degree of investing sophistication).

- Mutual fund strategies are long-only, meaning they cannot sell securities short.

- Mutual funds generally do not have a performance fee; they generally charge only a management fee.

Hedge Fund Structure

Hedge funds are generally very lean organizations: they can manage a high level of assets with relatively few employees. This makes breaking into a hedge fund much more difficult than traditional investment banks and asset management, because there are generally fewer jobs to go around. Such jobs are also much more competitive, due to the prestige associated with them, and the potential for superior compensation.

- Research Analyst

- Trader

- Portfolio Manager

- Risk Manager

- Marketing or Investor Relations

- Chief Financial Officer (CFO) & Chief Accounting Officer (CAO)

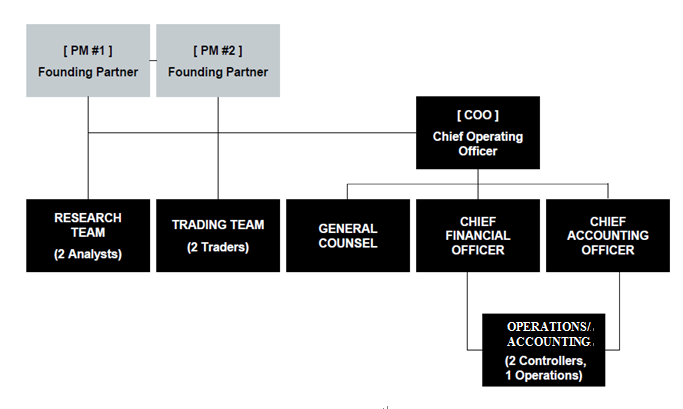

Below is a snapshot of a typical hedge fund structure. As the fund grows its assets under management (AUM), it will typically look to hire additional analysts to perform fund research while leveraging other employees at the firm.

Exhibit 3.1: Structure of a Hedge Fund